Bitcoin's growing water footprint

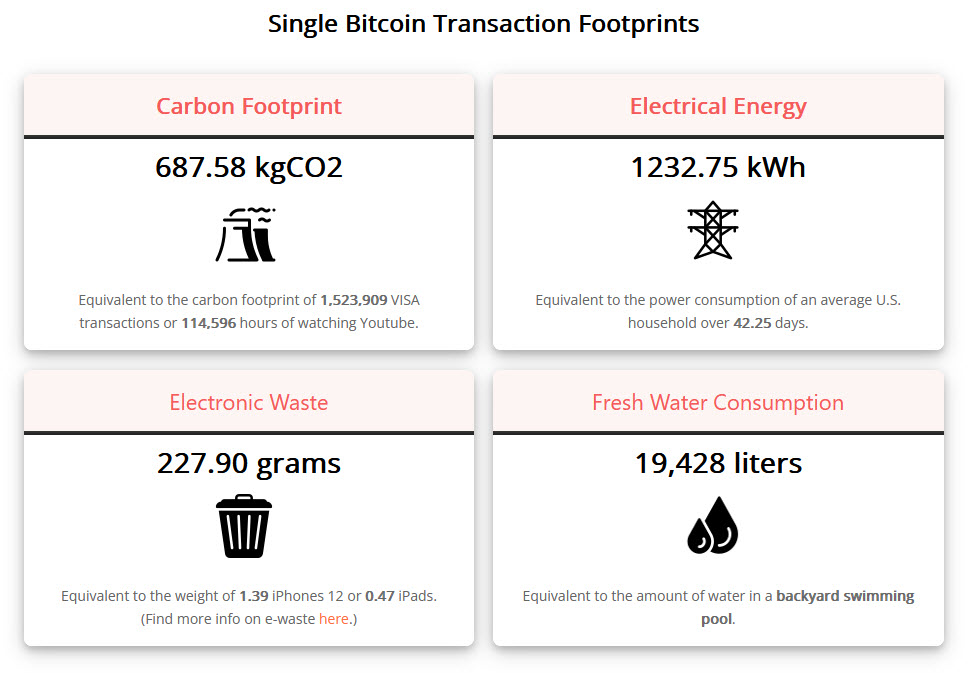

Amid growing concerns over the impacts of climate change on worldwide water security, Bitcoin’s water footprint has rapidly escalated in recent years. The water footprint of Bitcoin in 2021 significantly increased by 166% compared with 2020, from 591.2 to 1,573.7 GL. The water footprint per transaction processed on the Bitcoin blockchain for those years amounted to 5,231 and 16,279 L, respectively. As of 2023, Bitcoin’s annual water footprint may equal 2,237 GL. To address this increasing water footprint, miners could apply immersion cooling and consider using power sources that do not require freshwater. A change in the Bitcoin software could also significantly reduce the network’s water footprint. This is the summary of a new study published by Alex de Vries, Bitcoin’s growing water footprint, Cell Reports Sustainability (2024), https://doi.org/10.1016/j.crsus.2023.100004

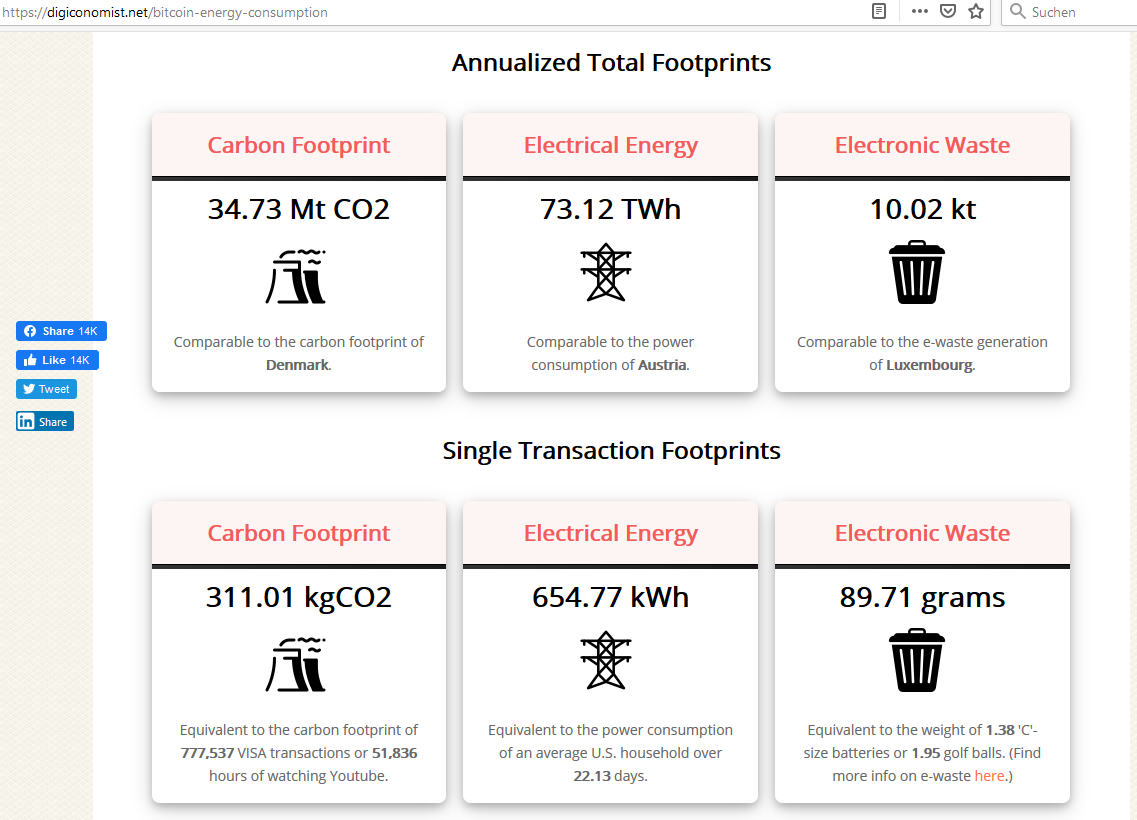

Bitcoin’s biggest problem is perhaps not even its massive energy consumption, but the fact that most mining facilties in Bitcoin’s network are located in regions (primarily in China) that rely heavily on coal-based power (either directly or for the purpose of load balancing). To put it simply: “coal is fueling Bitcoin”. So we decided to shift our attention (and awareness campaign) from the "TerawattHours" of energy consumption towards the climate crisis relevant numbers of carbon footprint. Revisiting this topic, A. de Vries published an updated study "revisiting Bitcoin's carbon footprint" in 2022.

Source: https://digiconomist.net/bitcoin-energy-consumption / Status per 2024-03-30

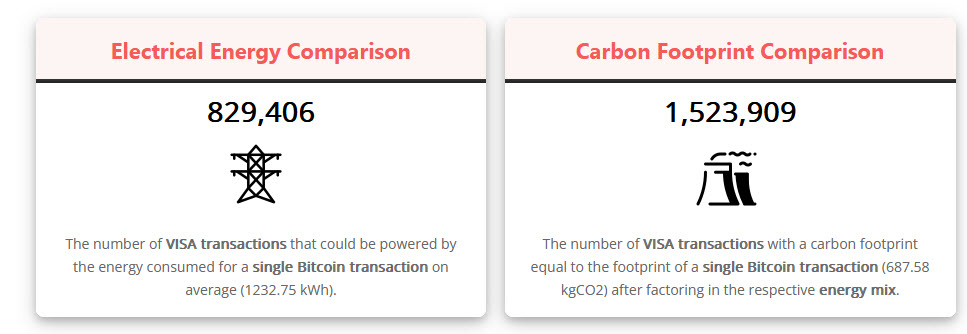

Comparing Bitcoin’s energy consumption to other payment systems

Source: https://digiconomist.net/bitcoin-energy-consumption

To put the energy consumed by the Bitcoin network into perspective we can compare it to another payment system like VISA for example. According to VISA, the company consumed a total amount of 740,000 Gigajoules of energy (from various sources) globally for all its operations. This means that VISA has an energy need equal to that of around 19,304 U.S. households. We also know VISA processed 138.3 billion transactions in 2019. With the help of these numbers, it is possible to compare both networks and show that Bitcoin is extremely more energy intensive per transaction than VISA. The difference in carbon intensity per transaction is even greater (see footprints), as the energy used by VISA is relatively “greener” than the energy used by the Bitcoin mining network. The carbon footprint per VISA transaction is only 0.45 grams CO2eq.

Of course, VISA isn’t perfectly representative for the global financial system. But even a comparison with the average non-cash transaction in the regular financial system still reveals that an average Bitcoin transaction requires several thousands of times more energy.

Bitcoin Mining contributes heavily to climate change

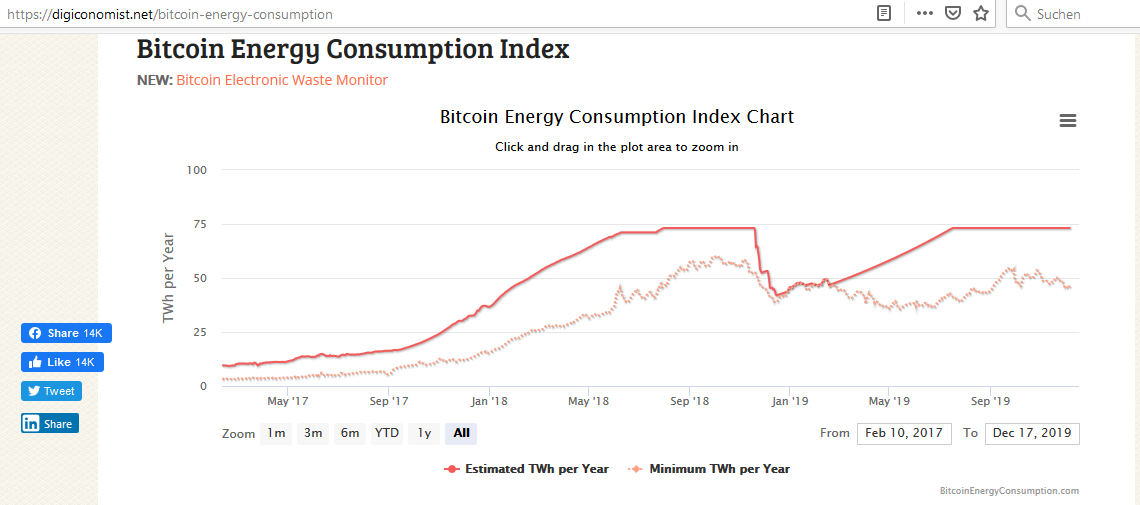

Bitcoin’s 2017 meteoric price rise has received major press attention with a lot of discussion around whether or not it’s a bubble waiting to burst. However, most the coverage has missed out one of the more interesting and unintended consequences of this price increase. That is the surge in global electricity consumption used to “mine” more Bitcoins.

According to Digiconomist’s Bitcoin Energy Consumption Index, as of Monday June 25th, 2018 Bitcoin’s current estimated annual electricity consumption stands at 71.2TWh. That’s the equivalent of 0.32% of total global electricity consumption, making it the 41st biggest electricity consumer as compared to all countries of the world. To put this into context, every single Bitcoin transaction can be attributed to about EUR 50.00 of energy costs (based on the viennese cost of electricity for about 1.011 KWh per transaction). Or every single Bitcoin transaction consumes the same amount of electricity as about 600.000 VISA transactions!

Updated data as per December 8th, 2019

Bitcoin’s biggest problem is perhaps not even its massive energy consumption, but the fact that most mining facilties in Bitcoin’s network are located in regions (primarily in China) that rely heavily on coal-based power (either directly or for the purpose of load balancing). To put it simply: “coal is fueling Bitcoin” (Stoll, 2019). So we decided to shift our attention (and awareness campaign) from the "TerawattHours" of energy consumption towards the climate crisis relevant numbers of carbon footprint (all data is of course still available at Digiconomist’s Bitcoin Energy Consumption Index ).

We cannot support this behaviour

As responsible and globally active enterprise, we decided to take a stand and do not support this waste of energy and threat to our global climate.

As responsible and globally active enterprise, we decided to take a stand and do not support this waste of energy and threat to our global climate.

So we decided to neither accept this CryptoCurrency nor use it - as an enterprise or as individual human beings. As specialists in developing payment solutions for webshops, we also refuse to embed Bitcoin payment services into our solutions. We further actively advocate this decision to our customers and business partnerns and ask them to join us in working against global climate change.

Status as per june 21, 2019: 67,5 TWh, 359.000 VISA transactions,

Status as per Monday December 15th, 2017